If you’re used to getting a paper check for your tax refund or mailing a check to pay your taxes, a significant change is on the way. The federal government is moving to an all-electronic system for payments and receipts, and this includes most transactions with the IRS.

Here’s what you need to know and how to prepare.

What’s Changing with IRS Checks (and Why)?

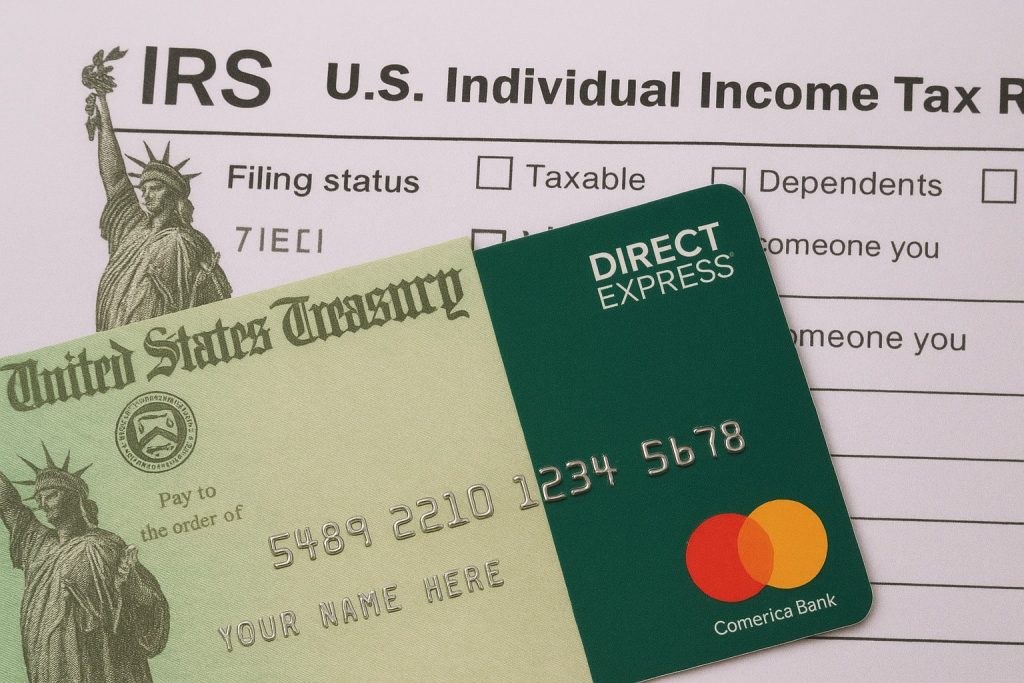

Starting September 30, 2025, the U.S. Department of the Treasury will stop issuing paper checks for most federal payments, including IRS tax refunds. It will also move most federal collections, like taxes owed, to electronic methods.

This move is designed to:

- Save on printing and mailing costs

- Reduce fraud and lost checks

- Deliver payments and refunds faster

- Modernize the federal payment system

While the government may grant some exceptions for hardship cases, the vast majority of taxpayers will need to use electronic options.

How to Prepare for the 2025 Paper Check Ban

This change affects you whether you’re receiving money from the IRS or sending money to the IRS.

If You Are Owed a Tax Refund…

The easiest way to get your refund after this date is via direct deposit.

- Action Needed: When you file your taxes, provide your bank account and routing number in the designated section.

- What If I Do Nothing? If you currently receive paper checks, don’t provide this information. Your refund will likely be delayed or issued on an electronic prepaid card. Now is the time to set up direct deposit.

If You Owe Taxes to the IRS…

You will no longer be able to simply mail a paper check for your tax bill.

- Action Needed: You must use an approved electronic payment method.

- Where to Go: The IRS provides several secure options, including bank transfers (Direct Pay) and credit/debit card payments. You can find all acceptable methods on the official IRS payments website.

What If You Don’t Have a Bank Account?

This transition poses a challenge for the “unbanked”—individuals without a traditional bank account. If you’re in this situation, you won’t be able to use direct deposit for your refund.

The federal government’s primary solution for this is the Direct Express® prepaid debit card.

Solution for the Unbanked: The Direct Express® Card

The Direct Express® program was created specifically for people who receive federal benefits (like Social Security or, in this context, tax refunds) but don’t have a bank account.

What is the Direct Express® Card?

It is a prepaid debit card where your federal payment is loaded directly onto the card. You don’t need a bank account to have one.

The card allows you to:

- Receive your federal payment automatically on the payment day.

- Make purchases anywhere Debit Mastercard® is accepted.

- Withdraw cash at ATMs.

- Pay bills online or over the phone.

- Get cash back from stores that offer it.

The card is FDIC-insured (up to the legal limit) and protected by consumer safeguards like Regulation E and Mastercard’s Zero Liability policy.

Is the Direct Express® Card a Government Program?

Yes, this is a legitimate program sponsored by the U.S. Treasury’s Bureau of the Fiscal Service. It’s the government’s official alternative to paper checks.

While the program is federal, the card itself is issued by a private bank (Comerica Bank) on behalf of the Treasury. The government’s official GoDirect.gov website promotes the Direct Express® card as the primary option for non-banked benefit recipients.

What About Fees?

Many essential features of the card are free. However, you should review the program’s fee schedule, as charges can apply for things like out-of-network ATM withdrawals or other specific services.

Final Warning: Beware of Scams

As this 2025 deadline approaches, scammers will try to take advantage of the confusion.

- Be highly suspicious of any email, text message, or phone call claiming to offer “paper check exceptions” or asking for your personal data to “verify” your electronic payment.

- The IRS will never initiate contact by email, text, or social media to request personal or financial information.

- Only use official websites like IRS.gov, GoDirect.gov, and USDirectExpress.com.