Taxpayers preparing for the 2025 federal return season have a new opportunity to lower their taxable income—but it requires preparation. Under the One Big Beautiful Bill Act, new deductions for overtime premiums and tip income take effect for the 2025 tax year.

While these deductions can significantly increase refunds for eligible workers, early IRS guidance suggests that documentation will be critical. Because 2025 is a transition year, employers are not yet required to break down these specific amounts on pay stubs, meaning the burden of proof is on you.

Here is everything you need to know about claiming these deductions and filing the new Schedule 1-A.

How the 2025 Overtime Deduction Works

The new deduction allows eligible hourly workers to deduct the “overtime premium” portion of their pay. It is important to note that the deduction applies only to the premium rate, not your total earnings during overtime hours.

Calculation Example

If you earn $10/hour regular pay and $15/hour for overtime:

-

Regular Rate: $10/hour

-

Overtime Rate: $15/hour

-

Deductible Amount: $5/hour (The premium only)

Note: If you are paid double-time or have an alternative pay structure, you must use IRS “reasonable methods” to isolate the premium if your employer does not break it out for you.

Who Qualifies for the Deduction?

Not every worker is eligible. The deduction is designed primarily for hourly employees subject to federal overtime rules.

-

Eligible: Hourly workers receiving time-and-a-half or similar premiums.

-

Ineligible: Most salaried professionals, executives, administrative roles, and commission-based salespeople exempt from federal overtime rules.

Income Limits & Caps

-

Single Filers: Capped at $12,500 (Phases out above $150k)

-

Married Filing Jointly: Capped at $25,000 (Phases out above $300k)

The New Tip Income Deduction Rules

Workers in approximately 70 tip-heavy occupations (including bartenders, drivers, and caddies) can deduct qualifying tips earned in 2025.

What Tips Qualify?

To claim this deduction on your 2025 return, tips must be:

-

Voluntary: Automatic service charges (like a mandatory 18% fee for large parties) do not qualify.

-

Reported: You must have a record of the tips (logs, Form 4070, or W-2 data).

Warning on Service Trades: Special restrictions apply to “Specified Service Trades or Businesses” (legal, medical, consulting, etc.). However, transitional relief may be available for 2025 depending on your specific role.

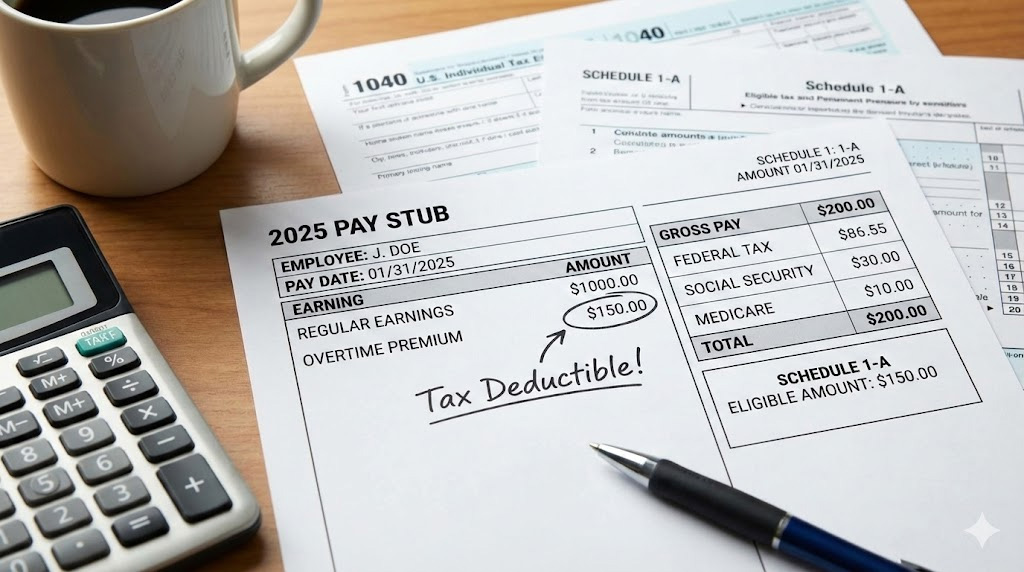

Critical Requirement: Record-Keeping for 2025

For the 2025 tax year, employers are not required to identify which portion of your pay qualifies for these deductions (that requirement begins in 2026). This means you must reconstruct this data yourself using:

-

Pay Stubs: Save every single stub from 2025.

-

Tip Logs: maintain a daily log (Form 4070A or a specialized app).

-

Work Schedules: Keep calendars showing overtime hours worked.

New Form Alert: Schedule 1-A

To claim these benefits, you will need to file the new Schedule 1-A with your 2025 Form 1040. This form is also used for car loan interest deductions and new senior benefits.

Action Plan: What to Do Now

Don’t wait until filing season in 2026. Start preparing now to ensure you don’t miss out on these deductions:

-

Audit your pay stubs immediately to see if overtime premiums are separated.

-

Calculate your “Qualified Overtime Compensation” monthly so you aren’t overwhelmed at year-end.

-

Verify your W-2 against your personal logs when it arrives.

Bottom Line

These deductions offer a significant tax break, but poor record-keeping could lead to IRS challenges. Treat your personal records as the ultimate proof for your 2025 return.